It’s 7am in San Francisco and Vancouver. In these different cities Khaled Nasr, George Akiki, and Anwar Sukkarie, are getting ready for their regular Investment Committee (IC) call with other fellow members of iSME’s investment committee.

It’s 5pm in Beirut. Bassel Aoun, Naji Boutros, Gilles De Clerck, and Dany Eid are also getting ready for their call of the day.

[Disclaimer: George Akiki, Khaled Nasr and Anwar Sukkarie are LebNet members].

iSME is a matching fund operated by Kafalat and funded by the Government of Lebanon and the World Bank. Three of LebNet’s members sit on its Investment Committee.

Despite the time difference, busy schedules, and remote calls, this is something they don’t want to miss. They’re keen to offer their informed judgement on which startup deserves funding from iSME, a $30 million USD matching fund by Kafalat, funded by the Government of Lebanon and the World Bank. Driven to play a key role in assessing promising startups and making sure the ones with the highest impact on job creation and society receive adequate funding.

They are all volunteers. They don’t own shares or sit on the board of any of the startups they decide to invest in nor are they financially involved. So why is motivation so high? And why put in all this effort? Simply for the love of giving back. “We all love Lebanon and think it has many issues, but one of the bright spots is its entrepreneurial spirit, level of education, and exposure to the outside world. The traditional economy is failing and there’s not enough to keep up with population growth so we see a brain drain,” said Khaled Nasr, general partner and COO at VC firm InterWest Partners in Silicon Valley.

From top, left to right: Dany Eid, Gilles De Clerck, Khaled Nasr, George Akiki, Naji Boutros and Anwar Sukkarie

In the face of the challenges of meeting and resolving conflicts remotely, as well as overcoming differences in mentalities and backgrounds, the IC members have found a way to always be involved and engaged, for the sake of Lebanon and its bright entrepreneurs. Five years in and the commitment is still going strong.

So what three qualities make a great investment committee?

Diversity

The IC members bring different skill sets into deal assessment, providing several points of view. Khaled Nasr is a Silicon Valley venture capitalist at InterWest Partners, Anwar Sukkarie is an entrepreneur and the founder of Loop, George Akiki is the co-founder and CEO of LebNet, Dany Eid is the CFO of Resource Group, Gilles De Clerck is a private equity investor at The EuroMena Funds, and Naji Boutros is the Chairman and CEO of Telegraph Capital Partners and the owner of Chateau Belle-Vue in Lebanon. This has proven to be highly beneficial for entrepreneurs.

“A private equity investor view puts a reality check on a VC dream and we felt that and it’s a good balance,” disclosed Tamim Khalfa, founder and CEO at delivery service Toters, whose company received a matching fund from iSME. His startup delivers thousands of orders a day and products worth millions of dollars per month, according to the founder.

“As a professional investor, the part that I had to adjust to is that this was not intended to be purely a financial investment. We were not just looking for a return on investment, but also to create an impact on the employment situation and create an ecosystem. We learnt to work with people with other backgrounds and it took me some adjustment so that I would look at other goals of iSME and assess accordingly,” said Nasr.

As a private equity investor, Gilles De Clerck believes his expertise in this field has helped startups prepare for the next wave. Likewise, Naji Boutros is convinced that each member has his own strength: “while most of us are VCs and PEs, some of us are also operators and understand the organization’s behavior and that is so important in startups.”

Respect

Dany Eid describes the committee’s approach to assessing startups as fair to the startups, selfless, and without ‘egos’. Khalfa added that “when [the iSME Investment Committee members] hear a convincing answer to their inquiries, they don’t keep doubting, and criticizing, and their questions make sense.” He also revealed that in his previous experiences with other VCs, the IC members used to break down the entrepreneur but that “you don’t need to put on a show or bully the entrepreneur if the answer isn’t convincing.”

Local and Global Insight

Having members in the US, Canada, and Lebanon brings entrepreneurs a wealth of advantages. “Those living abroad are quite familiar with Lebanon. When it came to scalability they were the experts. We were able to add value about our assessment of a pilot project running in Lebanon, but when an idea was to be replicated outside, this is where their experience comes in,” comments Eid. Agreeing, George Akiki recognizes the role of the members in Lebanon in assessing a startup’s scaling plans and validating if their expansion to a target market in the region is a smart move or not.

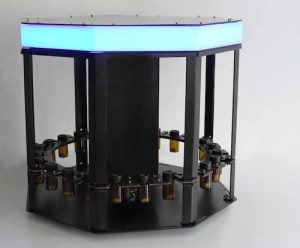

An example of this in action is Reef Kinetics, an iSME portfolio startup that manufactures automatic water testing devices for aquariums, tanks, and ponds. When looking to expand to international markets, Reef Kinetics benefited from IC members’ knowledge in marketing and distribution overseas. They now work with distributors in more than 55 countries across the US, Europe, and the GCC.

From early challenges to surviving difficult times

Founded in 2015, iSME is a co-fund that aims at encouraging early-stage equity financing in Lebanon. So far, it has made 18 equity investments, offered grants to 175 startups and supported 4 Lebanese angel funds.

Program manager Bassel Aoun explains that it was launched five years ago to encourage the creation of a healthy pipeline and to increase the supply of early stage financing by offering grants and equity co-investments to Lebanese startups.

Back in 2015, it was hard to convince other funds to offer co-investment opportunities for iSME, admitted Aoun who spoke about the challenges iSME faced trying to promote its concept. “The major challenge was to promote the fund to other VC funds and [to show them] the advantage of having a co-investor on board. […] From my experience, if you look at any deal in the VC industry and you look at the cap table, the smallest deal has three investors. You should have a co-investor to help you get follow on funding,” he divulged.

Another challenge was having international committee members because co-investors believed they would be hard to convince. One successful deal after the other removed these barriers and today, iSME builds very good relations with VCs in the market and co-invests with 90 percent of them.

During these extremely tough times, the idea of investing in high-risk startups in Lebanon might appear absurd. After all, many startups shut down and the remaining ones are bootstrapping their way out of a seemingly never-ending crisis. But resilience is key. Entities like iSME are struggling to keep the funding going, and this is why, Aoun explains, they are pausing new investments and prioritizing their portfolio startups: “we’re asking our startups to reduce cost and build a plan B, increase runway and survive for a minimum of 12 months. The money will go to those who prove they can run on survival mode.”

Tough times call for tough measures. Lebanon, startups, hang in there!

Feature image via Pixabay.